The shrinking rate of home price increases that has headlined the price data from most sources for months may have ended, at least according to CoreLogic Home Price Index (HPI), and the company is seeing more aggressive appreciation in the future. The HPI for May increased by 3.6 percent on an annual basis, up from a 3.5 percent gain in April. The month-over-month change was 0.9 percent.

Frank Nothaft, CoreLogic's chief economists said, "Interest rates on fixed-rate mortgages fell by nearly one percentage point between November 2018 and this May. This has been a shot-in-the-arm for home sales. Sales gained momentum in May and annual home-price growth accelerated for the first time since March 2018."

The states with the highest increases were Idaho, up 10.7 percent and Utah with a 7.8 percent gain. Number three was South Dakota where prices increased 7.7 percent, however neighboring North Dakota was the only state where prices fell on an annual basis. Las Vegas continues to have the largest price gains among metro areas, with an annual increase of 7.1 percent.

CoreLogic said its analysis of the 100 largest metropolitan areas in the country in terms of housing stock shows 38 percent are overvalued, that is their home prices are at least 10 percent higher than their long-run sustainable levels. Twenty-four percent of areas are considered undervalued, i.e. 10 percent or more below those levels, and 38 percent were at value. When only the top 50 markets are considered, 42 percent were overvalued, 42 percent were at value, and the remaining 16 percent were undervalued. Sustainable levels are those where prices are supported by local market fundamentals such as disposable income.

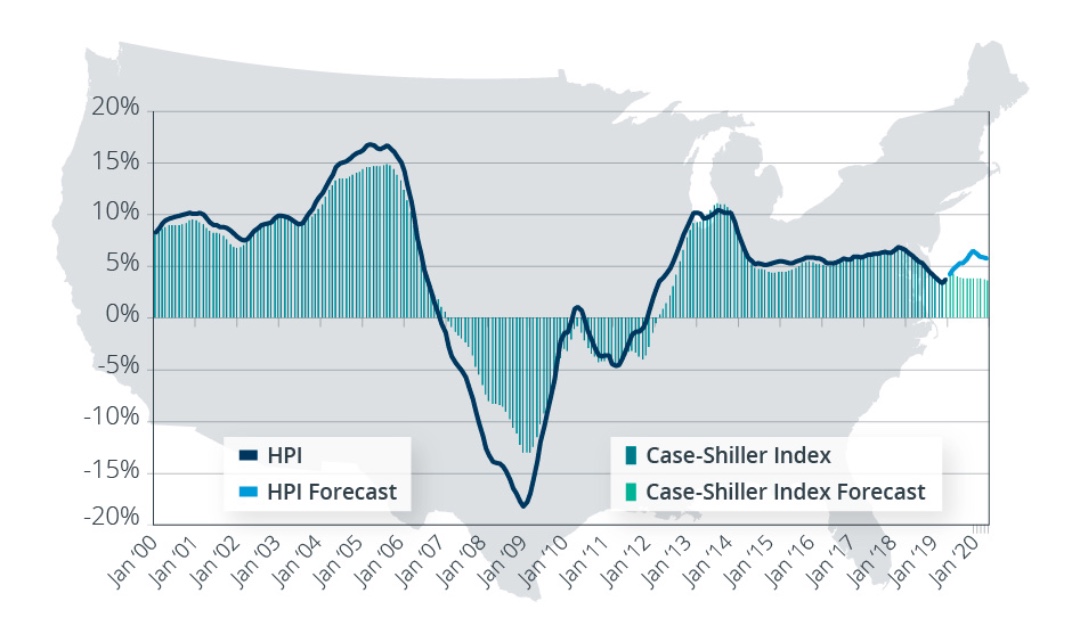

Corelogic's forward looking HPI anticipates an increase of 0.8 percent in home prices from May to June and 5.6 percent appreciation for the 12 months ending in June 2020. This graph shows a comparison of the national year-over-year change for the CoreLogic HPI and CoreLogic Case-Shiller Index from 2000 to the present month and with forecasts one year into the future. Both the CoreLogic HPI Single Family Combined tier and the CoreLogic Case-Shiller Index are posting positive, but moderating year-over-year percent changes, and forecasting gains for the next year.

Frank Martell, President and CEO of CoreLogic said, "The recent and forecasted acceleration in home prices is a good and bad thing at the same time. Higher prices and a lack of affordable homes are two of the most challenging issues in housing today, and every buyer, seller and industry participant is being impacted. The long-term solution lies in expanding supply, which will require aggressive and effective collaboration between policy makers, state and local government entities and home builders."

A survey done by CoreLogic and RTi Research in the first quarter measured consumer housing sentiment in high priced markets. They found that even the rapid increase of prices in those areas, available home supplies are still constrained "as homeowners question their ability to afford replacement homes." The survey found that a quarter of residents in high-priced markets bought a home in the past three years, while only 6 percent sold. Similarly, 22 percent said they plan to buy while only 7 percent plan to sell. Four in 10 sellers say that affording a new home would require them to move outside of their current market.